ANNUAL REPORT

2023–2024

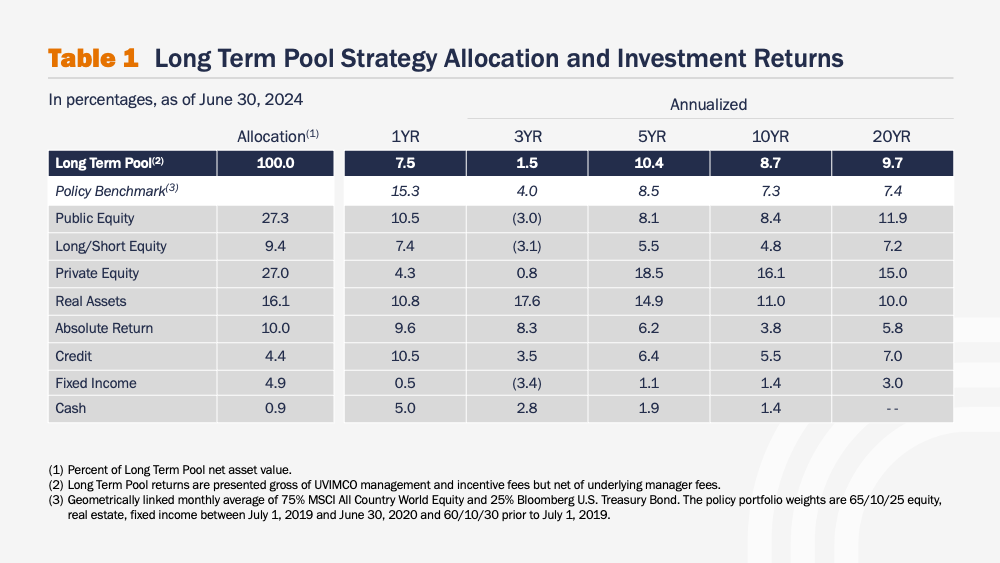

During the twelve months ending June 30, 2024, UVIMCO’s Long Term Pool (LTP) gained 7.5% and earned $1 billion in returns for our investors. While we are moderately pleased with these results, the LTP underperformed its passive policy benchmark, which rose by 15.3% during the fiscal year. In times of exceptional market performance, the LTP generally lags the policy benchmark due to our large allocation to illiquid assets. While having a diversified portfolio and a significant allocation to private investments means we don’t generally capture the height of short-term equity market gains, the LTP is also somewhat insulated from material losses in difficult market environments. Such was the case in fiscal year 2022 when the LTP declined 4.7% while the value of global equities fell by 15.4%. Regardless of the market backdrop, the LTP’s performance measurement is best aligned with its investment horizon: over the long term.

While past performance is no guarantee of future success, sticking with our investment approach over the past several decades has served the University quite well. Over the last ten and twenty years, the LTP has generated annualized returns of 8.7% and 9.7%, exceeding the policy portfolio returns by 1.4% and 2.3% per year, respectively. Such outperformance is particularly important as the policy portfolio’s historical and expected returns fail to preserve the purchasing power of the University’s endowment over time. UVIMCO’s performance also compares favorably to that of other colleges and universities, with the LTP generating returns in the top quartile of peers over the three-, ten-, and twenty-year periods.1

With UVIMCO’s fiftieth anniversary this year, it is especially fulfilling to see how our investment decisions from decades ago continue to provide both new opportunities and intergenerational equity for today’s students, alumni, staff, faculty, and patients. From breaking ground on the Paul and Diane Manning Institute of Biotechnology to opening the nation’s first School of Data Science, we have a glimpse of how our work today might influence the University’s world of tomorrow. In this report, we highlight the evolution of UVIMCO since 1974 and how our investments positively impact innovation on Grounds. We are honored to play such an important role in the University’s success and thank our investors and partners for their enduring support.

1 Periods ending June 30, 2023.

Serving

the University

The University of Virginia Investment Management Company (UVIMCO) provides investment management services to the University of Virginia (UVA) and University-associated organizations to serve the University’s mission.

UVA is an iconic public university with a long history of nationally ranked schools and programs, distinguished faculty, and innovative research discoveries. The University is ranked the no. 24 best overall university in the country, advancing one spot from last year, according to the U.S. News & World Report. The rankings also identify UVA as the no. 3 “Best Value School” among public institutions.

The partnership between UVIMCO, the University, and University-associated organizations is unique. Our collective work is steeped in a shared culture of excellence, commitment to being great and good, calling to serve the University, and deep roots in the Charlottesville community.

UVIMCO invests the endowment and other long-term funds of the University and associated organizations in its Long Term Pool with the primary objective of maximizing its long-term, inflation-adjusted returns commensurate with the risk tolerance of the University. Over the past decade, UVIMCO’s active management of the LTP added $1.7 billion more in value (as of June 30, 2024) than would have been gained by investing in the passive policy portfolio.

As of June 30, 2024, UVIMCO’s assets under management were $14.2 billion in the Long Term Pool and $88.3 million in the Short Term Pool (Graph 1). The Long Term Pool is comprised of the Rector and Visitors’ endowment ($7.2 billion), the University’s Strategic Investment Fund ($1.9 billion), other University long-term assets ($1.9 billion), and University-associated organizations’ funds ($3.2 billion), including the Darden School Foundation, Law School Foundation, UVA Alumni Association, and Jefferson Scholars Foundation.

OUR SUPPORT OF GREAT AND GOOD

UVA aims to be the best public university by 2030, and one of the very best in the world, whether public or private. UVIMCO’s investment management of the endowment and other long-term funds helps to enable some of the key initiatives that advance this important and ambitious goal.

UVA Expands Financial Aid Program for Virginia Families READ MORE+

UVA’s School of Data Science Opens, Realizing Dream of Historic $120 million Gift READ MORE+

UVA Graduate Schools Earn High Marks READ MORE+

Forbes Names UVA a ‘New Ivy’ in Fresh Look at Higher Education READ MORE+

The vast majority of the Long Term Pool is held in pooled investments and commingled funds, as well as in the forms of fixed income and cash, rather than through direct ownership of individual securities. These assets are invested with the best investment managers from around the globe—skilled individuals who bring diversity of thought, outstanding expertise, and innovation to their investment decisions—ultimately increasing the long-term value of the University’s assets.

The Short Term Pool serves important near-term liquidity needs and is primarily invested in U.S. Treasury notes, bonds, and bills with maturities of not more than one year, except for U.S. Treasury floating rate notes, which may have a maturity of up to two years. By varying allocations of investment funds between the Long Term Pool and Short Term Pool, investors can tailor an individualized portfolio to their desired risk and liquidity levels.

Since 2020, UVIMCO’s assets under management have grown from $9.9 billion to $14.2 billion (Graph 2). By generating returns in excess of the University’s spending rate plus inflation, UVIMCO is providing a steady source of income to support UVA’s mission for future generations of students, faculty, staff, alumni, and patients. Each year, a portion of an endowment fund's value is paid out to support the fund’s designated purposes, and earnings in surplus of this distribution build the endowment’s market value over time. This distribution supports an increasing number of scholarships, professorships, and research funds, and helps expand program offerings and facilities—with the ultimate effect of attracting some of the best students in the nation and world-class faculty to Grounds.

UVIMCO’s management of the endowment is particularly critical when other revenue sources decline. For more than a decade, endowment spending has surpassed state appropriations as a funding source for the University’s academic budget (Graph 3). This means that securing strong returns for the University is more important than ever in maintaining its role as one of the country’s top public universities.

UVIMCO INVESTMENT BOOTCAMP

In February 2024, UVIMCO launched its Investment Bootcamp, a program targeted at supporting second- and third-year UVA students interested in asset management who may have little previous experience in or exposure to the field. Over two days, UVIMCO hosted more than a dozen students at its downtown Charlottesville office, where our managing directors taught short courses on portfolio management and investment strategies. The team enjoyed networking with the UVA students and engaged with many participants following the Bootcamp, including Hamdael Eslaquit (quoted below), who will intern with UVIMCO in 2025.

Thank you all so much at UVIMCO for the wonderful experience! I learned a great deal about the endowment fund structure and had an absolute blast doing so. I can’t wait to see what’s in store for the future of UVIMCO!

Jacob Saul (UVA Class of 2026)

So grateful to the UVIMCO team for their time and expertise in providing this amazing experience! It was a wonderful learning opportunity and I have truly loved every conversation I was able to have with members of the team. Looking forward to seeing how future bootcamps continue to develop and grow the UVA community!

Alexa Sison (UVA Class of 2027)

Thank you, UVIMCO, for the incredible opportunity to participate in the inaugural Investment Bootcamp! I am grateful for the learning experience and am looking forward to all that UVIMCO has to offer.”

Hamdael Eslaquit (UVA Class of 2027)

Investment Philosophy & Tenets

UVIMCO’s investment philosophy guides its strategy through the challenges that the world brings to ensure that our decisions are sound and grounded in what we know works best for achieving excellent long-term results for the University.

WE FOCUS ON THE LONG TERM.

UVIMCO’s investment horizon is measured in years, if not decades, which aligns with the mission of the University as well as the perpetual nature of an endowment.

WE BELIEVE IN ACTIVE MANAGEMENT.

UVIMCO has a long history of partnering with exceptional investment managers who have demonstrated the ability to generate alpha and outperform the passive policy benchmark through disciplined investment processes, novel insights, and hard work.

WE EMPLOY A GLOBAL, FLEXIBLE INVESTMENT MANDATE.

UVIMCO’s investment process is structured and disciplined, but also flexible and innovative in response to constantly evolving global financial markets.

WE EVALUATE AND MANAGE RISK.

UVIMCO dynamically measures and manages risk based on the risk tolerance and capital requirements of the University.

Rotunda & The Lawn, Central Grounds

Fiscal Year 2024

Performance

UVIMCO’s primary objective is to generate inflation-adjusted, long-term returns in excess of the University’s spending rate, thereby achieving our goal of generating a steady source of income to support UVA’s mission.

UVIMCO’s investment performance and strategy start with successful asset allocation and alignment with asset owners. UVIMCO’s investment policy includes a policy portfolio allocation, which our Board of Directors establishes based on the University’s risk tolerance and expected future capital requirements. The Board carefully considers capital market risk and return estimates to ensure that the policy portfolio is appropriately designed to achieve the objectives of the Long Term Pool. The policy portfolio serves as an indicator of how the endowment would fare under passive management.

UVIMCO has a long history of partnering with exceptional investment managers, who generate superior returns for the University. Our returns relative to the policy portfolio demonstrate the added value of active management through our internal investment team and external investment managers.

Our managers invest in Public Equity, Long/Short Equity, Private Equity, Real Assets, Absolute Return, Credit, and Fixed Income. Graph 4 displays the trends in the asset allocation of the Long Term Pool over the past decade, with shifts in recent years primarily due to relative performance.

Fiscal year 2024 was a stellar year for global equities, with the MSCI ACWI gaining almost 20% despite sticky inflation and high interest rates for most of the year. Both global and domestic public equity markets (S&P 500 Index: +24.6%) were propelled by a sustained rally of the “Magnificent 7” mega-cap technology companies (Bloomberg Magnificent 7: +52.1%), which heavily benefited from investor excitement around artificial intelligence. Globally, developed markets (MSCI World: +20.8%) surpassed emerging markets (MSCI Emerging Markets: +13.0%) by a wide margin. Within emerging markets, India was one of the largest positive contributors (MSCI India: +34.9%), while foreign investors remained disenchanted with Chinese equities (MSCI China: –1.4%). By the end of the fiscal year, the 10-year U.S. Treasury yield rose to 4.4% as Treasuries sold off in response to political uncertainties and increased issuance.

Against this market backdrop, the Long Term Pool returned 7.5% and earned $1 billion in returns for our investors during the fiscal year. Public Equity (+10.5%) and Long/Short Equity (+7.4%) trailed the MSCI ACWI (+19.9%) by a large margin, in part due to our longstanding biases to small-caps and emerging markets, as well as underexposure to the select mega-cap companies that led the market rallies. Private strategies collectively generated 4.3%, while Real Assets (+10.8%) and our diversifying strategies (+6.5%) provided important diversification and meaningful returns for the Long Term Pool.

The Long Term Pool generally underperforms the policy benchmark during times of exceptional market performance. The primary factor impacting the Long Term Pool's fiscal year performance is its ~45% allocation to private investments, which drives significant basis risk versus the all-liquid passive benchmark. Importantly, the success or failure of private investments can only be properly evaluated over long time periods that capture complete market cycles, provide ample opportunity for innovation to take hold, and enable business improvements to bear fruit. While past performance is no guarantee of future success, relatively consistent commitments to private investments over the past several decades have served the University quite well.

Historically, we have been well paid for assuming market, manager, and liquidity risks that differ from that of the policy portfolio. Our longer-term performance (Table 1) continues to be excellent compared to both the policy benchmark and the required return. Over the last ten and twenty years, the Long Term Pool has generated annualized returns of 8.7% and 9.7%, exceeding the policy portfolio returns by 1.4% and 2.3% per year, respectively. The ten- and twenty-year annualized returns also exceed the 8.0% return required to preserve the purchasing power of the endowment over time.

According to Wilshire Trust Universe Comparison Service (TUCS) data, UVIMCO consistently outperforms its institutional peers in addition to securing long-term returns above the policy benchmark and required return. Over the past twenty years, UVIMCO’s annualized return of 9.7% has well exceeded the 7.3% garnered by median peers (Graph 5).

In fiscal year 2025, UVIMCO remains focused on generating long-term, risk-adjusted returns for the University and associated organizations in perpetuity.

Rotunda in Spring

Celebrating

50 Years

While the first University of Virginia endowment check was written close to a century ago, we like to think that professional investment management of UVA’s endowment starts with the hiring of Alice Handy—the first person to manage the University’s investments—in 1974. As we highlighted in last year’s report, Alice Handy deeply impacted UVA for almost 30 years and served as the cornerstone of UVA’s endowment investment management program. In this report, we celebrate not only Alice’s contributions but other meaningful people, decisions, and market movements that have shaped what UVIMCO is today.

The following timeline highlights the key events in the history of UVA’s endowment from 1974 through 2024. Follow along through the years and expand each decade to explore our milestones.

The History of UVA’s Endowment: 1974 – 2024

1970s Beginning

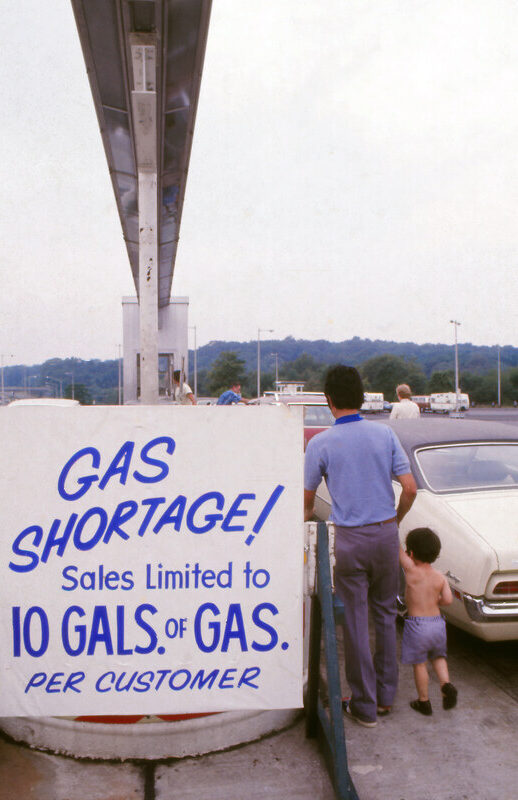

1973: Arab Oil Embargo: Ceased U.S. oil imports from participating OAPEC nations, reducing supply and causing prices to quadruple.

1974: Endowment AUM $50 million

1974: UVA reorganizes its endowment portfolio, diversifies holdings and hires new external fund managers.

1974: UVA hires Alice Handy as the first investment officer. Read more about Alice's impact in last year's report.

1978: UVA hires Cambridge Associates as an external consultant.

1980s Expansion and Diversification

1980: Endowment AUM $142 million

1980: UVA has a relatively progressive portfolio with a 75% allocation to equities.

1982: UVA makes initial investment in venture capital.

1986: UVA reallocates a portion of the endowment from international equities to global fixed income.

1987: Black Monday (October 19): Largest one-day stock decline in history with the Dow Jones Industrial Average dropping 22.6% in a single trading session.

1987: UVA begins to manage the fixed income portfolio internally.

1990s Creation of UVIMCO

1990: Endowment AUM $464 million

1991: UVA earns strong returns through real estate investments via three external investment managers.

1997: UVIMCO diversifies its portfolio through hedge funds and long/short equity.

1998: UVA Board of Visitors Finance Committee establishes the University of Investment Management Company as a subcommittee.

1999: Dow breaks 10,000.

1999: Venture capital portfolio grows to just over $200 million; UVIMCO introduces derivatives as a portfolio hedge strategy.

2000s UVIMCO Independence

2000: Endowment AUM $1.7 billion

2000: Dot-Com IPO bubble burst following a significant rise from 1995 to 2000, the NASDAQ fell by 75% March 2000 to October 2002, erasing most of its prior gains.

2001: UVIMCO establishes its own independent charter and mission.

2003: Hedge funds represent over 50% of UVIMCO's portfolio.

2004: Chris Brightman joins as CEO/CIO, further develops UVIMCO as an independent organization with its own Board of Directors and governance model.

2005: University-associated organizations invest over $400 million with UVIMCO.

2006: UVIMCO adopts revised asset allocation to decrease hedge fund allocation and increase exposure to private investments over time.

2008: Great Financial Crisis: The worst U.S. economic disaster since the Great Depression with the U.S. stock market wiping out $8 trillion in value.

2009: UVIMCO's fiscal year return is -21% as the Great Financial Crisis' impact is felt in the portfolio.

2010s Recovery and Strategic Growth

2010: Endowment AUM $4.5 billion

2011: UVIMCO expands focus on co-investment opportunities in private equity, real estate, and resources to benefit from favorable investment terms and fees.

2011: Larry Kochard joins as CEO/CIO, changes UVIMCO's asset allocation to increase the overall liquidity position of UVIMCO's portfolio.

2012: Spending distributions from UVA endowment exceed state appropriations for the first time.

2012: UVIMCO launches the Short Term Pool to preserve principal and provide a more liquid investment vehicle to UVA and associated organizations.

2015: UVIMCO establishes the Sherri King Memorial Scholarship.

2016: Brexit Referendum: The UK elected to leave the European Union, significantly impacting the UK's economy.

2017: Yale University recognizes UVIMCO as a top twenty-year endowment performer, surpassing by a comfortable margin the returns of stocks, stocks/bond mix, and bonds.

2018: Robert Durden joins as CEO/CIO, leads UVIMCO through the global pandemic and resulting market volatility.

2020s Resilience and Forward Thinking

2020: Endowment AUM $9.9 billion

2020: Pandemic-induced recession: The COVID-19 pandemic and resulting lockdowns triggered a sharp contraction of economic activity and massive job losses.

2020: UVIMCO increases focus on absolute return investments that are uncorrelated with broader market movements.

2021: UVIMCO forms its Advisory Committee on Investor Responsibility (ACIR) to guide investor responsibility decisions.

2021: UVIMCO generates a historical fiscal year return of 49% and gains more than $4.8 billion in value for investors.

2022: UVIMCO continues to increase overall allocation to private investments.

2024: Endowment AUM $14.2 billion

2024: UVIMCO continues to perform in the top quartile of its peers over ten- and twenty-year periods.

Looking Back on UVIMCO

Being Great and Good:

Impact Stories

An endowed gift is a powerful investment in the future of the University and its affiliated organizations. When invested in UVIMCO’s Long Term Pool, endowed funds serve as a sustainable source of funding professorships to recruit and retain distinguished faculty; scholarships and fellowships to support deserving students; lectureships to bring distinguished speakers to Grounds; library acquisitions to support world-class scholarship; and academic prizes to recognize outstanding students and faculty. The University’s unrestricted endowment generates vital funding for operations and enables the University to respond to important needs as they arise.

ENDOWING TECHNOLOGY EXCELLENCE

UVA DEVELOPS OPEN-SOURCE LIBRARY OF COMPUTER-ASSISTED DESIGN MODELS FOR K-12

Professors at the School of Education and Human Development are leading a national effort to expand the use of open-source hardware in K-12 schools. Known as the Educational CAD Model Library, a wide variety of peer-reviewed scientific tools will be made accessible to schools, including 3D printers, computer-controlled microscopes, biochemistry experiment equipment, specialized tanks for studying wave phenomenon, and electromagnetic apparatus for science demonstrations.

“By providing open access to high-quality, peer-reviewed educational resources, the CAD Library not only provides an innovative approach to supporting the diverse learning needs of teachers and their students, but also nurtures a responsive and inclusive approach to STEM education,” said UVA Professor Glen Bull.

RESEARCHERS HARNESS AI TO ENHANCE ARTIFICIAL PANCREAS FUNCTION

UVA health researchers conducted a successful clinical trial of a data-driven artificial pancreas system that may lead to better delivery of life-saving insulin for patients with type 1 diabetes. Researchers used artificial intelligence (AI) to enhance efficiency and function of insulin “pump” delivery systems, potentially improving blood sugar maintenance levels compared to a non-AI supported delivery system.

“This opens the door to real-time, AI-driven personalized insulin delivery,” said Boris Kovatchev, director of the UVA Center for Diabetes Technology. Development of innovations to improve treatment options and improve patient care is a key priority under UVA Health’s 10-year strategic plan and is aligned with the mission of UVA’s forthcoming Paul and Diane Manning Institute of Biotechnology.

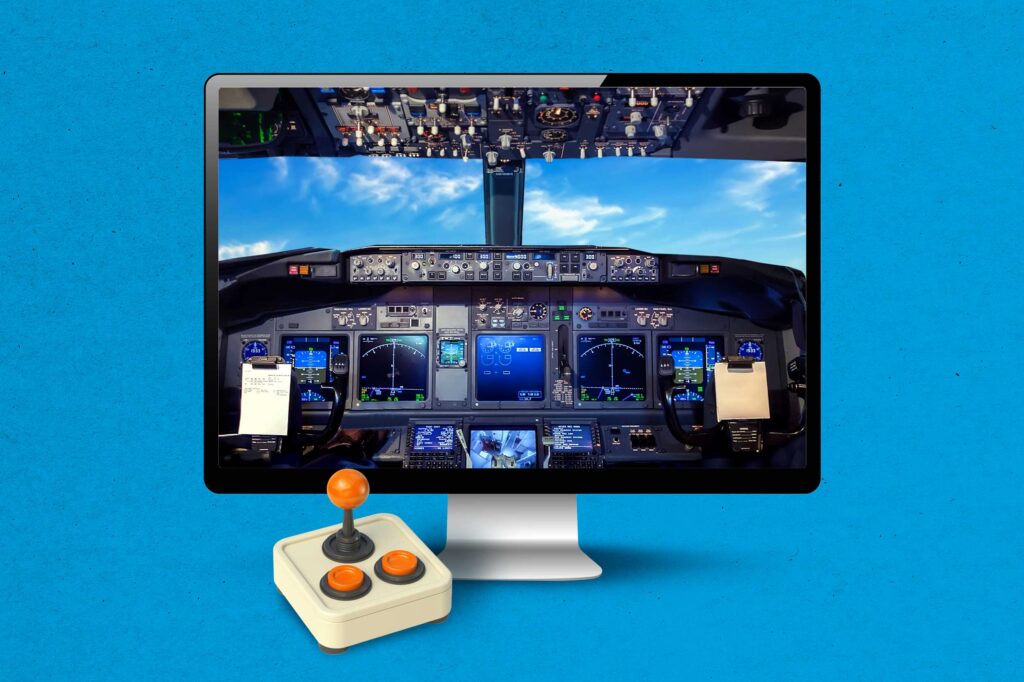

VIRTUAL REALITY FLIGHT SIMULATORS EXPAND OPPORTUNITIES FOR AIR FORCE ROTC CADETS

The Jefferson Trust awarded a first-ever grant to UVA’s Air Force ROTC aimed at increasing the availability of virtual reality flight training and simulator options on Grounds. The grant funding will enhance training opportunities and increase the number of pilots graduating from UVA. The new equipment provides photorealistic replicas of the same training aircraft used by the United States Air Force and Navy.

This funding “affords UVA cadets and prospective UVA students the opportunity to develop procedural knowledge and potential interest in serving as a pilot in the world’s greatest air force,” said Col. Jason B. Bell, commander of ROTC Detachment 890. The University’s Air Force ROTC detachment is rated among the top 10% in the country.

AI TOOL TO IMPROVE HEART FAILURE CARE

UVA Health researchers have developed a powerful new risk assessment tool for predicting outcomes in heart failure patients. The new tool improves on existing risk assessment tools for heart failure by harnessing the power of machine learning and AI to determine patient-specific risks of developing unfavorable outcomes with heart failure. The model, called CARNA, uses anonymized data from thousands of patients to quickly summarize risk factor and assist physicians in making personalized care recommendations. As part of its ten-year strategic plan commitment to improve care for patients across Virginia and beyond, UVA Health has made CARNA freely available to clinicians.

“The collaborative research environment at the University of Virginia made this work possible by bringing together experts in heart failure, computer science, data science, and statistics,” said researcher Kenneth Bilchick, MD, a cardiologist at UVA Health. “Multidisciplinary biomedical research … will be critical to helping our patients benefit from AI in the coming years and decades.”

Investor

Responsibility

UVIMCO utilizes an Investor Responsibility Framework, which guides our responsible investing approach and rests on the assumption that proactive management of environmental, social, and governance (ESG) factors enhances our ability to deliver strong, risk-adjusted returns for the University.

Our 2024 Investor Responsibility Report outlines the continued progress made toward our investor responsibility goals. Over the past year, we strengthened our engagement with external managers on material ESG risks and opportunities, deepened our approach to climate risk, and continued investing in energy transition opportunities. To learn more about UVIMCO’s responsible investing efforts, visit our “Responsibility” page.

Meet

the Team

UVIMCO Board of Directors

UVIMCO’s Board of Directors is comprised of a diverse and distinguished group of industry leaders who provide essential guidance on UVIMCO’s investment strategy to ensure the continued success of the University of Virginia’s mission.

UVIMCO Team

UVIMCO’s team is comprised of investment and operational professionals who are passionate about the University and dedicated to achieving excellence in investment management. We value integrity, collaboration, excellence, intellectual honesty, and diversity of thought. We strive to be included in the top quartile of university endowments by generating superior investment returns, maintaining an exceptional reputation, and serving as a true partner to the University. Our leadership team members bring strong investment acumen, diverse skill sets, deep knowledge of the industry, and enthusiasm to serve the University every day.