Performance

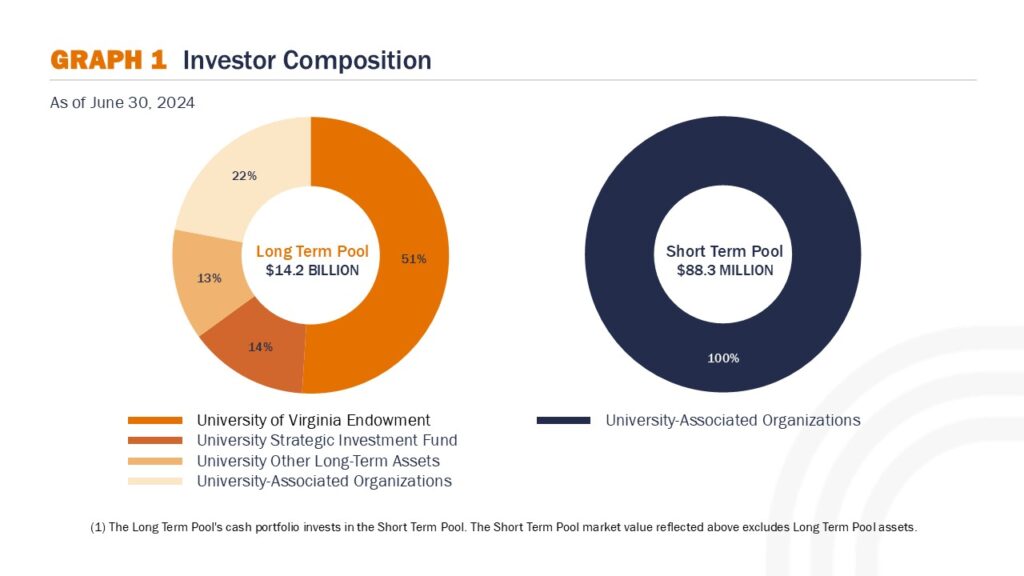

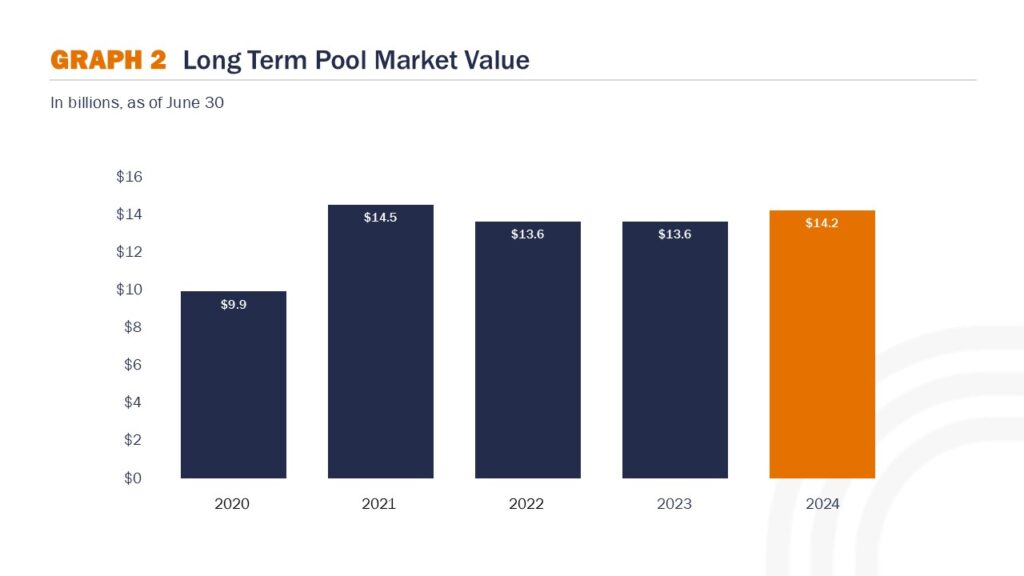

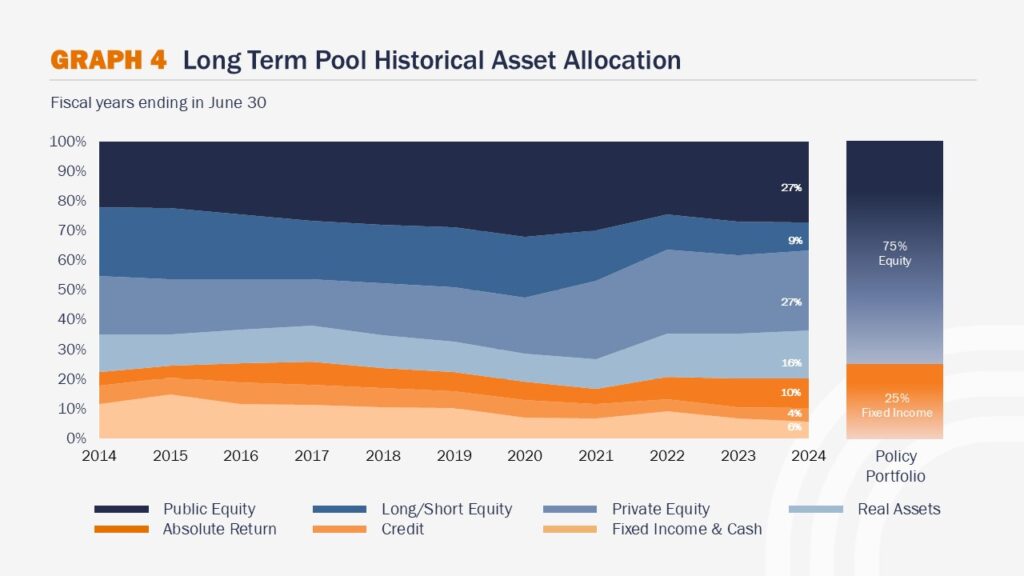

UVIMCO provides investment management services to the University of Virginia and associated organizations to serve the University’s mission. UVIMCO’s primary objective is to maximize the long-term, inflation-adjusted returns commensurate with the risk level of the University. Its secondary objective is to secure higher returns than the passive policy portfolio, which provides asset allocation guidelines for the Long Term Pool.