ESG INTEGRATION

UVIMCO incorporates environmental, social, and governance integration in its investment process, while maintaining strong long-term returns for the University of Virginia and associated organizations.

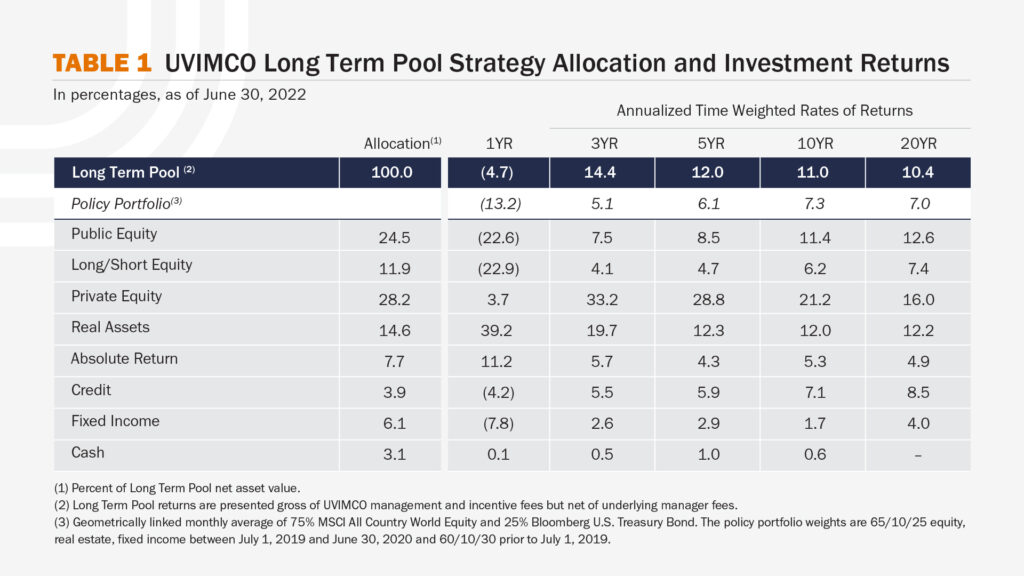

Global equities and bonds lost value during the twelve months ending June 30, 2022, reflecting a challenging market environment. High inflation and geopolitical uncertainties, layered on top of a fragile, pandemic-stricken world economy, drove markets into correction territory. Against this backdrop, UVIMCO’s diversified portfolio declined by 4.7% during the fiscal year compared to a 13.2% loss for the passive policy portfolio. Negative returns generated by our Public Equity, Long/Short Equity, and Fixed Income portfolios were partly offset by gains in Real Assets and Absolute Return.

In the 2021 fiscal year, UVIMCO’s Long Term Pool generated a historic return of 49%. While we celebrated the many benefits that increase would provide to the University of Virginia, we also acknowledged that such a strong gain would surely come at the expense of future returns. Markets are bound by gravity, after all. While we never like to report a loss to our investors, this fiscal year’s 4.7% decline in the Long Term Pool’s value represents a relatively modest reversal of the previous year’s gains. With that said, markets offer no assurances of modesty or otherwise, and the investment environment will likely remain challenging.

Short-term volatility in markets and in our own portfolio reminds us to focus most on long-term results. For decades, UVIMCO has met its primary objective of maintaining the purchasing power of the University’s long-term investments. Over the last three, five, and ten years, the Long Term Pool has generated annualized returns of 14.4%, 12%, and 11%, respectively. These compare favorably with our required return as well as our passive policy benchmark.

I have our team to thank for our ongoing success—their investment acumen, superior manager selection, and passion for the University are second to none. Our Board of Directors, an exceptional group of industry leaders and University graduates, has guided us through short-term challenges without losing sight of our longer-term goals. In this report, we highlight one of our current Board members, John Harris Jr. (Law ’79), and his time at UVA and as an industry leader.

Our long-term returns supported countless University initiatives this year. The Jefferson Scholars Foundation awarded full merit scholarships to a record number of highly accomplished high school seniors, the Law School enabled law students to work in public service roles this summer, and the Health System established the first center of its kind dedicated to advancing immunotherapeutic cancer treatments. We encourage you to read more about these University initiatives in the Impact Stories section of this report.

We are humbled by the noble work of the University, and it inspires us to remain focused on our mission. Patience, resilience, and an opportunistic mindset remain at the heart of our investment philosophy, and we are passionate about pursuing investment excellence on behalf of the University and broader community. Successful investing is not only about how much money we manage, but our ability to preserve and grow it for future generations of University students, staff, faculty, and alumni. I know that we are well-positioned for future success, and we thank our investors for their continued support and strong partnership.

The University of Virginia Investment Management Company (UVIMCO) provides investment management services to the University of Virginia (UVA) and University-associated organizations to serve the University’s mission.

UVA is an iconic public university with a long history of nationally ranked schools and programs, distinguished faculty, and innovative research discoveries. Now in its third century, the University boasts an affordable, accessible, and world-class education.

The partnership between UVIMCO, the University, and University-associated organizations is unique. Our collective work is steeped in a shared culture of excellence, commitment to being great and good, calling to serve the University, and deep roots in the Charlottesville community.

Newsweek Names UVA Medical Center No. 1 Hospital in Virginia

UVA School of Law Ranked No.1 Public by U.S. News

CodeSignal finds UVA No. 1 in Software Engineering, Topping Standard-Bearers Stanford, Cal-Berkeley

UVA Children's Hospital Ranked No. 1 in Virginia by U.S. News

UVIMCO invests the endowment and other long-term funds of the University and associated organizations in its Long Term Pool with the primary objective of maximizing its long-term, inflation-adjusted returns commensurate with the risk level of the University. As of June 30, 2022, UVIMCO’s assets under management were $13.6 billion in the Long Term Pool and $175.8 million in the Short Term Pool (Graph 1). Within UVIMCO’s Long Term Pool, $7 billion represents the Rector and Visitors' endowment, $1.9 billion represents the University’s Strategic Investment Fund, $1.7 billion represents other University long-term assets, and $3 billion represents assets held by University-associated organizations, including the Darden School Foundation, Law School Foundation, UVA Alumni Association, and Jefferson Scholars Foundation.

The vast majority of the Long Term Pool is held in pooled investments and commingled funds, as well as in the forms of fixed income and cash, rather than through direct ownership of individual securities. These assets are invested with the best investment managers from around the globe, who bring diversity of thought, outstanding expertise, and innovation to their investment decisions—ultimately increasing the long-term value of the University’s assets.

The Short Term Pool serves important near-term liquidity needs and is primarily invested in U.S. Treasury notes, bonds, and bills with maturities of not more than one year, except for U.S. Treasury floating rate notes, which may have a maturity of up to two years. By varying allocations of investment funds between the Long Term Pool and Short Term Pool, investors can tailor an individualized portfolio to their desired risk and liquidity levels.

Since 2018, UVIMCO’s assets under management have grown from $9.5 billion to $13.6 billion (Graph 2). By generating returns in excess of the University’s spending rate plus inflation, UVIMCO is providing a steady source of income to support the University’s mission for future generations of students, faculty, staff, alumni, and patients. Each year, a portion of the endowment value is paid out to support the funds’ designated purposes, and earnings in surplus of this distribution build the endowment’s market value over time. This distribution supports an increasing number of scholarships, professorships, and research funds, and helps expand program offerings and facilities—with the ultimate effect of attracting some of the best students in the nation and world-class faculty to Grounds.

UVIMCO’s management of the endowment is particularly critical when other revenue sources decline. Over the past decade, endowment spending has surpassed state appropriations as a funding source for the University’s academic budget (Graph 3). This means that securing strong returns for the University is more important than ever in maintaining its role as one of the country's top public universities.

UVIMCO’s investment philosophy guides its strategy through the challenges that the world brings to ensure that our decisions are sound and grounded in what we know works best for achieving excellent long-term results for the University.

WE FOCUS ON THE LONG TERM.

UVIMCO’s investment horizon is measured in years, if not decades, which aligns with the mission of the University as well as the perpetual nature of an endowment.

WE BELIEVE IN ACTIVE MANAGEMENT.

UVIMCO has a long history of partnering with exceptional investment managers who have demonstrated the ability to generate alpha and outperform the passive policy benchmark through disciplined investment processes, novel insights, and hard work.

WE EMPLOY A GLOBAL, FLEXIBLE INVESTMENT MANDATE.

UVIMCO’s investment process is structured and disciplined, but also flexible and innovative in response to constantly evolving global financial markets.

WE EVALUATE AND MANAGE RISK.

UVIMCO dynamically measures and manages risk based on the risk tolerance and capital requirements of the University.

UVIMCO’s primary objective is to generate inflation-adjusted, long-term returns in excess of the University’s spending rate, thereby achieving our goal of generating a steady source of income to support UVA’s mission.

UVIMCO’s investment performance and strategy starts with successful asset allocation and alignment with asset owners. UVIMCO’s investment policy includes a policy portfolio allocation, which its Board of Directors establishes based on the University’s risk tolerance and expected future capital requirements. The Board carefully considers capital market risk and return estimates to ensure that the policy portfolio is appropriately designed to achieve the objectives of the Long Term Pool. The policy portfolio serves as an indicator of how the endowment would fare under passive management.

UVIMCO has a long history of partnering with exceptional investment managers who have demonstrated the ability to generate alpha and outperform the passive policy portfolio through disciplined investment processes, novel insights, and hard work. Our returns relative to the policy portfolio demonstrate the added value of active management through its internal investment team and external investment managers.

Our managers invest in Public Equity, Long/Short Equity, Private Equity, Real Assets, Absolute Return, Credit, and Fixed Income. Graph 4 displays the trends in the asset allocation of the Long Term Pool over the past decade, which has remained relatively stable. Between 2020 and 2022, the shift in asset allocation was a function of relative performance.

Fiscal year 2022 was a difficult market environment for investors. Global equities experienced market volatility, with the MSCI ACWI down 15.4% at the end of June. Bonds also traded off during the fiscal year, disappointing investors relying on their typically diversifying qualities and reminding them that Treasuries bear price risk prior to maturity. Energy and food prices continued to rise, exposing systemic supply-chain weaknesses. In response, central banks aggressively tightened monetary policy to rein in inflation, sparking fears of a recession despite a strong U.S. job market.

In the face of market volatility, UVIMCO’s Long Term Pool declined 4.7% during this fiscal year. However, it outperformed the passive policy portfolio by 8.5%, demonstrating the investment acumen of the UVIMCO team and external managers. The returns of our investment strategies fluctuate from year to year. The strategies that did well last year—Public Equity, Private Equity, and Long/Short Equity—significantly underperformed this year and were offset by gains in Real Assets and Absolute Return. Our resources portfolio, buoyed by appreciating energy prices, served as an important diversifier for the Long Term Pool.

The success of UVIMCO’s portfolio is best viewed through a long-term lens and against key benchmarks (Table 1). Over the past two decades, we have secured double-digit returns for our investors. Our twenty-year annualized return of 10.4% is well in excess of the 8.0% return required to preserve the purchasing power of the endowment. Public Equity generated an annualized return of 12.6%. Long/Short Equity generated an annualized return of 7.4%. Private Equity generated an annualized return of 16.0%. Real Assets generated an annualized return of 12.2%. Absolute Return generated an annualized return of 4.9%. Credit and Fixed Income generated annualized returns of 8.5% and 4.0%, respectively.

According to Wilshire Trust Universe Comparison Service (TUCS) data, UVIMCO consistently outperforms its institutional peers. Over the past twenty years, UVIMCO’s Long Term Pool had an annualized return of 10.4% compared to 7.0% for the policy portfolio and 7.4% for our median peer (Graph 5).

As we look ahead to fiscal year 2023, UVIMCO’s focus remains on partnering with the best external investment managers in the world on superb investment ideas to generate long-term, risk-adjusted returns for the University and associated organizations for generations.

JOHN B HARRIS JR.

Retired Senior Banker and Executive, Deutsche Bank

John Harris Jr. is a distinguished member of UVIMCO’s Board of Directors. Harris is a retired executive of Deutsche Bank, where he developed a track record of success in managing multiple businesses on five continents. Since leaving banking, Harris has committed his career to public service and has over forty years of experience as a nonprofit board member, officer, advisor, fundraiser, and volunteer in the education, social services, and civil rights fields.

There is an old adage that says, “The only certainty is uncertainty.” It has been my experience that this is a useful way to view financial markets—especially so when geoeconomics and geopolitical forces are in play.

While we do not have the absolute ability to determine financial, economic, and political outcomes, we do have the ability to think in terms of the probability of outcomes, and to consider trade-off judgements, risk/return calculations, and cost/benefit analysis.

I encourage people to embrace the view that financial market outcomes cannot be certain. Thus, we should make decisions and take actions based on the probability of outcomes instead of the certainty of outcomes. This approach leads to better decision-making, better actions and often better outcomes.

Any story about UVIMCO’s success must start and end with its team. From the quality to the performance of the operations, risk, and manager selections teams, UVIMCO has an exceptional staff of highly skilled individuals who are at the core of UVIMCO’s sustained long-term success. UVIMCO attracts and inspires people who want to pursue best-in-class investing while supporting UVA’s pursuit of excellence in higher education. We are a team of people driven by both private-sector incentive and nonprofit-sector mission—a powerful combination for success.

UVIMCO’s Board of Directors plays an integral role in cultivating excellence in investing. Structurally, the Board strikes a balance between experience and new perspectives, as well as independence combined with representation of key UVA stakeholders. The Board’s culture is one of robust engagement that encourages honest debate, diversity of views, intellectual honesty, and transparency.

I was raised in segregated Richmond, Virginia, by two Historically Black College and University (HBCU) business school professors. From an early age, I observed the powerful impacts of economic opportunity and empowerment. Although the legal and political landscapes began to change during my childhood, economic and social inequities were often intractable roadblocks for my mother and father and the vast majority of African Americans.

DE&I is so important in the investment industry because it is economically advantageous. The industry is inextricably linked to economic drivers of wealth: jobs, businesses, and nonprofits, including institutions of higher learning such as UVA. Looking back at my parents’ generation of Black Virginians, it is clear to me that segregation resulted in huge economic costs for the Commonwealth and the nation. The failure of Virginia to fully utilize the talents of all of its citizens came at a heavy price that is still felt today.

Although legal segregation is no longer a barrier today, obstacles ranging from racial and gender bias to a nondiverse pipeline for qualified talent continue to define the industry. Accordingly, DE&I is an essential tool in the toolbox of remedies that must be used if we are truly committed to the American ideals of justice, equal opportunity, and excellence.

UVIMCO has demonstrated leadership in advancing DE&I initiatives. Recently, the Board enhanced its new-member selection process by significantly broadening its outreach beyond its traditional pipeline of potential Board candidates. The Board is committed to building a diversity of people, representation, competencies, experiences, and perspectives on the UVIMCO team and further aligning UVIMCO’s work with the University’s commitment to being both great and good.

An endowed gift is a powerful investment in the future of the University and its affiliated organizations. When invested in UVIMCO’s Long Term Pool, endowed funds serve as a sustainable source of funding professorships to recruit and retain distinguished faculty; scholarships and fellowships to support deserving students; lectureships to bring distinguished speakers to Grounds; library acquisitions; and academic prizes to recognize outstanding students and faculty. The University’s unrestricted endowment generates vital funding for operations and enables the University to respond to important needs as they arise.

UVIMCO’s expert management of the University’s endowment and long-term funds, as well as the funds of associated organizations, enables excellence and equity in all corners of the University and is demonstrated in the impact stories that follow.

JEFFERSON SCHOLARS FOUNDATION AWARDS RECORD NUMBER OF FULL SCHOLARSHIPS

Fifty-two outstanding high school seniors received full merit scholarships from the Jefferson Scholars Foundation this fall to pursue their undergraduate studies at the University of Virginia. The scholarships cover the full cost of attending UVA for four years, as well as a comprehensive enrichment program featuring foreign travel, career networking and counseling, and exclusive access to venture funding through the foundation’s Exploratory Fund. Scholarship recipients demonstrate excellence and potential in the areas of leadership, scholarship, and citizenship.

Through [our] scholarship programs, we seek to identify individuals who are motivated to lead not by selfish ambition, but by a desire to make the world better for others. Ultimately, we aim to recruit well-rounded, community-minded leaders who are committed to making a positive impact on the University."

Jimmy Wright, President, Jefferson Scholars Foundation

Record Number of Grants Funded to Support Law School Students Working in Public Service

Supported by a record grant pool of $801,000, 167 UVA Law students worked in public service roles in summer 2022. These grants, funded by gifts from alumni and other donors, and invested in part by UVIMCO, are awarded to first- and second-year law students who have secured a public service position across a wide variety of institutions and areas, including federal and state court systems, public defense, prosecution, and nonprofit legal services.

With the Law School funding 100% of baseline Public Service Summer Grants and additional funding coming through PILA+ grants, UVA Law students now have more options than ever for pursuing public service and judicial internships."

Annie Kim, Director, Program in Law and Public Service, UVA Law School

UVA Health System Invests in World’s First Ultrasound Cancer Center

In May 2022, leading physician researchers at UVA announced the launch of the Focused Ultrasound Cancer Immunotherapy Center, the first center of its kind dedicated to advancing revolutionary immunotherapeutic cancer treatments. The center is designed to capitalize on UVA’s proven achievements in innovative cancer therapies to better understand a patient’s immune response to cancers. Thanks to UVA’s initial investment of $8 million, three groundbreaking clinical trials are already underway, focusing on patients with metastatic and early-stage breast cancers.

Our combined initial investment of $8 million will purchase state-of-the-art focused ultrasound devices, create new jobs to hire faculty and staff, and fund laboratory research studies and clinical trials."

Dr. K. Craig Kent, Chief Executive Officer, UVA Health

UVIMCO is dedicated to investor responsibility as an organization and as investors. Responsible investing is incorporated into UVIMCO’s investment strategy by our leadership team and staff. We consider all risks that could have an impact on the performance of UVIMCO’s portfolio, including environmental, social, and governance (ESG) risks. UVIMCO promotes ESG integration across its portfolio and with its investment managers and is committed to aligning with a net-zero future by 2050. Read more in UVIMCO’s Investor Responsibility Framework and Investor Responsibility Report.

Click on the images to learn more

UVIMCO incorporates environmental, social, and governance integration in its investment process, while maintaining strong long-term returns for the University of Virginia and associated organizations.

UVIMCO is committed to transitioning the University’s endowment and other investments in the portfolio to net-zero by 2050.

UVIMCO will continue to invest in climate solutions that reduce greenhouse gas emissions in the real world. In 2022, UVIMCO invested with managers who are dedicated to investing in markets, technologies, and services that support the transition to a net-zero economy.

UVIMCO engages with its investment managers on material ESG issues, including reducing greenhouse gas emissions, to help effect positive change in relevant industries.

UVIMCO Board of Directors

UVIMCO’s Board of Directors is comprised of a diverse and distinguished group of industry leaders, who provide essential guidance around UVIMCO’s investment strategy to ensure the continued success of the University of Virginia’s mission. Meet the Board of Directors.

UVIMCO Leadership

UVIMCO’s team is comprised of forty-two professionals who are passionate about the University and dedicated to achieving excellence in investment management. We value integrity, collaboration, excellence, intellectual honesty, and diversity of thought. We strive to be included in the top quartile of university endowments by generating superior investment returns, maintaining an exceptional reputation, and serving as a true partner to the University. Our leadership team members bring strong investment acumen, diverse skill sets, deep knowledge of the industry, and enthusiasm to serve the University every day. Meet the Leadership Team.