ANNUAL REPORT

2022–2023

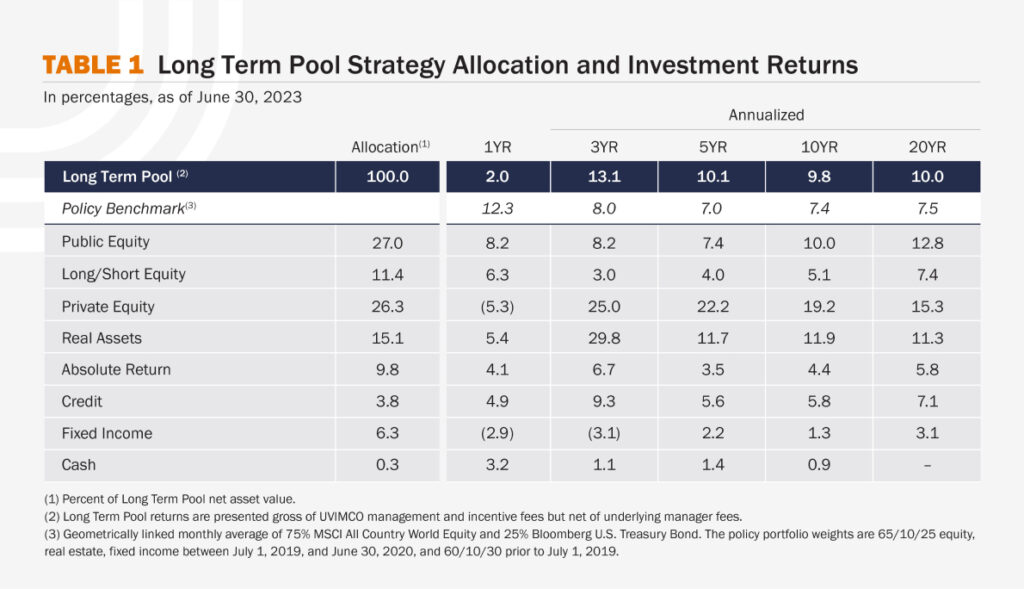

Fiscal year 2023 proved to be both volatile and challenging for long-term institutional investors. During the twelve months ending June 30, 2023, the Long Term Pool gained 2% but underperformed both the policy portfolio (12.3%) and other passive market indices. The University of Virginia Investment Management Company’s Private Equity strategies unwound a portion of prior year gains, while the Public Equity and Long/Short Equity portfolios underperformed broad markets.

Resilience – or our capacity to withstand challenging years and ability to stick with our investment strategy – is critical to our long-term success. Fortunately, the nature of endowment investing gives us the ability to be patient during times of market volatility, while short-term losses provide opportunities for future long-term gains. We are working hard to identify and underwrite pockets of value created by current market movements while also actively seeking the next generation of investment partners. Resilience is also evidenced in the diversified nature of our investments. For example, gains in diversifying strategies such as Real Assets, Absolute Return, and Credit provided important support to the overall Long Term Pool return during the fiscal year.

We believe that time in the market is better than timing the market. The Long Term Pool’s twenty-year annualized return of 10% exceeds both the returns of the passive benchmark (7.5%) and the return needed to preserve the purchasing power of the University’s endowment (8%). We are pleased with this level of historical performance but continuously reflect upon our investment process and existing portfolio to help ensure future success.

Our hard work has a singular focus: to support the University of Virginia in perpetuity. Our investment and operations teams work hard every day to ensure we remain the absolute best financial partner to the University. While many factors change over time—from the University to the market to our team—our mission and values remain a steady guiding light. In this report, we highlight how our impact shows up on Grounds, from supporting key initiatives in the “Great and Good Plan” to different aspects of the Virginia athletics program. We are honored to play such an important role in the University’s success and thank our investors and partners for their enduring support.

Serving

the University

The University of Virginia Investment Management Company (UVIMCO) provides investment management services to the University of Virginia (UVA) and University-associated organizations to serve the University’s mission.

UVA is an iconic public university with a long history of nationally ranked schools and programs, distinguished faculty, and innovative research discoveries. The University is ranked the no. 2 best value public university by Princeton Review, moving up one spot from the previous year. UVA is also ranked the best public college in the nation for financial aid for the third year in a row.

The partnership between UVIMCO, the University, and University-associated organizations is unique. Our collective work is steeped in a shared culture of excellence, commitment to being great and good, calling to serve the University, and deep roots in the Charlottesville community.

UVIMCO invests the endowment and other long-term funds of the University and associated organizations in its Long Term Pool with the primary objective of maximizing its long-term, inflation-adjusted returns commensurate with the risk level of the University.

OUR SUPPORT OF GREAT AND GOOD

UVA aims is to be the best public university in 2030, and one of the very best in the world, whether public or private. UVIMCO’s investment management of the endowment and other long-term funds helps to enable some of the key initiatives that advance this important and ambitious goal.

UVA leverages $100 million gift to launch Paul and Diane Manning Institute of Biotechnology READ MORE+

UVA invests additional $65 million in Bicentennial Funds READ MORE+

$10 million investment in 'Cavalier Fund' to broaden opportunities for students READ MORE+

UVA’s plans for a School of Data Science READ MORE+

As of June 30, 2023, UVIMCO’s assets under management were $13.6 billion in the Long Term Pool and $266.6 million in the Short Term Pool (Graph 1). Within UVIMCO’s Long Term Pool, $7 billion represents the University of Virginia endowment, $1.9 billion represents the University’s Strategic Investment Fund, $1.7 billion represents other University long-term assets, and $3 billion represents assets held by University-associated organizations, including the Darden School Foundation, Law School Foundation, UVA Alumni Association, and Jefferson Scholars Foundation.

The vast majority of the Long Term Pool is held in pooled investments and commingled funds, as well as in the forms of fixed income and cash, rather than through direct ownership of individual securities. These assets are invested with the best investment managers from around the globe who bring diversity of thought, outstanding expertise, and innovation to their investment decisions ultimately increasing the long-term value of the University’s assets.

The Short Term Pool serves important near-term liquidity needs and is primarily invested in U.S. Treasury notes, bonds, and bills with maturities of not more than one year, except for U.S. Treasury floating rate notes, which may have a maturity of up to two years. By varying allocations of investment funds between the Long Term Pool and Short Term Pool, investors can tailor an individualized portfolio to their desired risk and liquidity levels.

Since 2019, UVIMCO’s assets under management have grown from $9.6 billion to $13.6 billion (Graph 2). By generating returns in excess of the University’s spending rate plus inflation, UVIMCO is providing a steady source of income to support the University’s mission for future generations of students, faculty, staff, alumni, and patients. Each year, a portion of the endowment value is paid out to support the funds’ designated purposes, and earnings in surplus of this distribution build the endowment’s market value over time. This distribution supports an increasing number of scholarships, professorships, and research funds, and helps expand program offerings and facilities - with the ultimate effect of attracting some of the best students in the nation and world-class faculty to Grounds.

UVIMCO’s management of the endowment is particularly critical when other revenue sources decline. For more than a decade, endowment spending has surpassed state appropriations as a funding source for the University’s academic budget (Graph 3). As a result, UVIMCO’s strong returns are more important than ever in ensuring that the University of Virginia remains one of the best public universities in the country.

UVIMCO MENTORSHIP PROGRAM

UVIMCO serves the University beyond managing its assets and generating strong long-term returns. Recently, UVIMCO formed a mentorship program with the McIntire School of Commerce’s Commerce Cohort to mentor high-achieving first-year students interested in finance, while strengthening the connection between UVIMCO and the University.

I was excited about the mentorship opportunity because I could gain more information about the world of investing and UVIMCO. Having the chance to do this with someone as my guide seemed perfect. Having a mentor with experience and expertise to advise me and provide feedback is essential for my collegiate and professional path. Knowing that I am building a relationship with someone supporting me and investing in my success gives me a confidence I wouldn't have otherwise."

Olivia Colston, 2nd year UVA student

Proactively reaching out to people interested in the investment industry is vitally important. Finance can seem opaque and daunting to those without prior experience or background, which is why early and clear communication with students is vital to get people who may not be open to pursuing the investment path otherwise. Having more career resources available is always a good thing, and being able to provide information and answer questions one-on-one is the best way to help young people determine whether the investment management industry is one they are interested in."

Harry Heyworth, UVIMCO Operations Associate

Investment Philosophy & Tenets

UVIMCO’s investment philosophy guides its strategy through the challenges that the world brings to ensure that our decisions are sound and grounded in what we know works best for achieving excellent long-term results for the University.

WE FOCUS ON THE LONG TERM.

UVIMCO’s investment horizon is measured in years, if not decades, which aligns with the mission of the University as well as the perpetual nature of an endowment.

WE BELIEVE IN ACTIVE MANAGEMENT.

UVIMCO has a long history of partnering with exceptional investment managers who have demonstrated the ability to generate alpha and outperform the passive policy benchmark through disciplined investment processes, novel insights, and hard work.

WE EMPLOY A GLOBAL, FLEXIBLE INVESTMENT MANDATE.

UVIMCO’s investment process is structured and disciplined, but also flexible and innovative in response to constantly evolving global financial markets.

WE EVALUATE AND MANAGE RISK.

UVIMCO dynamically measures and manages risk based on the risk tolerance and capital requirements of the University.

Fiscal Year 2023

Performance

UVIMCO’s primary objective is to generate inflation-adjusted, long-term returns in excess of the University’s spending rate, thereby achieving our goal of generating a steady source of income to support UVA’s mission.

UVIMCO’s investment performance and strategy starts with successful asset allocation and alignment with asset owners. UVIMCO’s investment policy includes a policy portfolio allocation, which our Board of Directors establishes based on the University’s risk tolerance and expected future capital requirements. The Board carefully considers capital market risk and return estimates to ensure that the policy portfolio is appropriately designed to achieve the objectives of the Long Term Pool. The policy portfolio serves as an indicator of how the endowment would fare under passive management.

UVIMCO has a long history of partnering with exceptional investment managers who have demonstrated the ability to generate alpha and outperform the passive policy portfolio through disciplined investment processes, novel insights, and hard work. Our returns relative to the policy portfolio demonstrate the added value of active management through our internal investment team and external investment managers.

Our managers invest in Public Equity, Long/Short Equity, Private Equity, Real Assets, Absolute Return, Credit, and Fixed Income. Graph 4 displays the trends in the asset allocation of the Long Term Pool over the past decade, with shifts in recent years due primarily to relative performance.

During fiscal year 2023, investors shrugged off concerns regarding rising interest rates and elevated inflation. In addition to improvements in investor sentiment, significant advances in the accessibility of generative artificial intelligence drove outsized equity returns, as evidenced by the MSCI All Country World Index’s (ACWI) return of 17.1%. Domestically, U.S. unemployment was under 4%, consumer inflation slowed from 9.1% to 3%, real U.S. GDP grew by 2.6%, and the S&P 500 gained 19.6% over the course of the fiscal year. Similarly, Japanese and developed European equity markets generated double-digit gains (in USD). China proved an exception to global equity market optimism with the MSCI China Index declining by 16.7%, mostly driven by geopolitical factors and domestic policy challenges. In the face of overall strong equity markets and rising interest rates, U.S. Treasury bond markets posted negative returns with the blended Bloomberg U.S. Treasury Bond Index losing 1.7% for the year.

This market backdrop proved challenging for diversified institutional portfolios with significant allocations to private investments. During the twelve months ending June 30, 2023, the Long Term Pool gained 2% and underperformed the 12.3% return generated by its policy portfolio benchmark. Our Public Equity and Long/Short Equity portfolios suffered from outsized exposures to emerging markets, particularly China. Additionally, our developed market managers were not able to fully capture the strong gains seen in the domestic equity market. Private investments significantly lagged public markets, with our Private Equity portfolio declining by 5.3% while global public equities rose substantially. Growth Equity, Venture Capital, and Resources underperformed the MSCI ACWI by wide margins due to both routine lags in valuation adjustments and the industry exposures of underlying investments. Diversifying strategies of Fixed Income and Cash, Absolute Return, and Credit collectively returned 1.6% and outpaced the blended Bloomberg U.S. Treasury Bond Index by 3.4% but failed to fully compensate for the one-year underperformance of the Long Term Pool’s equity investments.

Fortunately, the impact of valuation timing for private investments differences dissipates over multi-year periods, which is one reason why we focus most on long-term performance data. Further, we believe that bearing different market, manager, and liquidity risks than the policy benchmark helps us earn exemplary investment results over time. Our historical performance (Table 1) continues to be excellent over longer time periods compared to both the policy benchmark and required return. Over the last ten and twenty years, the Long Term Pool has generated annualized returns of 9.8% and 10%, exceeding the policy portfolio returns by 2.4% and 2.5% per year, respectively. The ten and twenty-year annualized returns are well in excess of the 8% return required to preserve the purchasing power of the endowment.

In addition to securing long-term returns above the policy benchmark and required return, UVIMCO consistently outperforms its institutional peers according to Wilshire Trust Universe Comparison Service (TUCS) data. Over the past twenty years, UVIMCO’s annualized return of 10% has well exceeded the 7.5% garnered by median peers (Graph 5).

As we look ahead to fiscal year 2024, UVIMCO’s focus remains on generating long-term, risk-adjusted returns for the University and associated organizations in perpetuity.

In Memoriam:

Alice Handy

ALICE HANDY

Former UVIMCO President

Alice Handy, a giant in the investment world and former UVIMCO president, passed away in May 2023. Handy was known for her true love of investing in nonprofits and constantly embracing challenge and opportunity wherever she could find it. With 29 years of managing the University of Virginia endowment (1974-2003) under her belt, starting as the first investment officer, moving up to treasurer, and then leading UVIMCO as its first president, she had a deep impact on UVA and the endowment management world. Handy created an innovative investment strategy that helped to substantially grow the endowment and shape UVIMCO into what it is today. Beyond her impact on the endowment, she was a dynamic person who left an indelible mark on all who knew her. Handy enthusiastically served as a role model, friend, and leader, and was known as a trendsetter, risk taker, and breaker of glass ceilings. She will be profoundly missed by those who knew her, and we are thankful for her enduring impact on the endowment.

Handy had many words of wisdom that she shared with her fellow investors, but one quote in particular summed up her view of investing: “To fail conventionally is better than succeeding unconventionally. The market offers a lot of slam dunks in hindsight, but if you’re really valuation-oriented and you think about it, there’s always something to be done.”

Read more about Handy’s outsized impact on the University and UVIMCO in UVA Today.

Alice was a truly transformative individual, who not only changed the course of my life, but her impact on the University’s Endowment, and ultimately the University as a whole, was immense. Her influence in the investment world, of course, goes way beyond the University, as she accomplished so much with Investure and the various university and philanthropic boards that she served on."

Rob Freer, former Managing Director, UVIMCO

Being Great and Good:

Impact Stories

An endowed gift is a powerful investment in the future of the University and its affiliated organizations. When invested in UVIMCO’s Long Term Pool, endowed funds serve as a sustainable source of funding professorships to recruit and retain distinguished faculty; scholarships and fellowships to support deserving students; lectureships to bring distinguished speakers to Grounds; library acquisitions; and academic prizes to recognize outstanding students and faculty. The University’s unrestricted endowment generates vital funding for operations and enables the University to respond to important needs as they arise.

ENDOWING ATHLETIC EXCELLENCE

The Virginia Athletics Foundation (VAF), through its fundraising efforts, strives to support a preeminent intercollegiate athletics program at the University of Virginia by providing student-athletes the opportunity to achieve academic and athletic excellence. UVIMCO manages assets on behalf of VAF, ultimately enhancing the University’s athletics program by securing strong long-term returns used for important initiatives, including scholarships and academic support for student-athletes.

The UVA athletics program ranks fourth in the nation, based on results from the National Association of Collegiate Directors of Athletics. The University of Virginia finished third in 2010 and fourth in 2014, respectively; placed in the top twenty-five for the sixteenth consecutive year; and is one of only ten schools to rank in the top thirty of the final Directors’ Cup standings in every year of the competition.

3-PEAT! UVA SWIMMERS ESTABLISH DYNASTY WITH LATEST CHAMPIONSHIP

The University of Virginia women’s swimming and diving team established a dynasty when it won a third consecutive national title. The top-ranked Cavaliers, led by coach Todd DeSorbo and Olympians Kate Douglass and Alex Walsh, dominated the NCAA championship meet in Knoxville, Tennessee, outscoring the second-place finisher, the University of Texas, by 127 points. UVA swept all five relay races and added six individual NCAA championships.

NCAA CHAMPIONS SAVOR LATEST STORYBOOK ENDING

In 2022, UVA entered the NCAA men’s tennis tournament as the no. 7 seed and exited with the title. The Cavaliers came into this year’s tournament seeded no. 5, and once again they were the last team standing. After winning three matches at the Boar’s Head Resort in Charlottesville, the Wahoos flew to Orlando, where they knocked off no. 4 seed Kentucky in the quarterfinals, no. 1 seed Texas in the semifinals, and, the no. 3 seed Ohio State in the NCAA final.

UVA MEN’S GOLF MAKES HISTORY BY ASCENDING TO NO. 1 RANKING

The nation’s leading men’s college golf team resides on Grounds. Golfweek released its collegiate rankings in September 2022, and, for the first time in program history, the University of Virginia topped the list. Entering the season, UVA returned its top two players from the previous year, fourth-year student Pietro Bovari and third-year George Duangmanee, and added a couple of coveted first-year students in Ben James and Bryan Lee, headliners to the best recruiting class in program history.

UVA SPORTS FAST FACTS

33 total NCAA Championship titles and 9 non-NCAA titles through May 2023

8 UVA athletes earned an ACC Player of the Year award in the 2022-2023 athletic year

Over 100 UVA athletes named to an All-ACC Team or Honorable Mention in the 2022-2023 athletic year

$19.7 million raised in VAF’s Annual Fund in 2022 to fund all athletic scholarships in conjunction with endowment distributions

Investor

Responsibility

In 2022, UVIMCO released its Investor Responsibility Framework and inaugural Investor Responsibility Report, which rest on the assumption that the deliberate integration of environmental, social, and governance (ESG) considerations leads to better investment processes and enhances long-term, risk-adjusted investment returns.

Our 2023 Investor Responsibility Report outlines the significant progress made in the past year toward the goals laid out in both the Framework and the 2022 report. Over the past year, we gathered more in-depth insights on our managers’ ESG policies; deepened engagement with external managers on overall ESG integration and, specifically, climate change; undertook extensive efforts to measure and assess the carbon footprint of our portfolio; and continued investing in climate solutions across multiple asset classes. We also enhanced the sustainability of our own operations by measuring our operational emissions footprint, upholding robust governance practices, and continuing to prioritize our people above all else.

Meet

the Team

UVIMCO Board of Directors

UVIMCO’s Board of Directors is comprised of a diverse and distinguished group of industry leaders, who provide essential guidance around UVIMCO’s investment strategy to ensure the continued success of the University of Virginia’s mission. Meet the Board of Directors.

UVIMCO Leadership

UVIMCO’s team is comprised of forty-two professionals who are passionate about the University and dedicated to achieving excellence in investment management. We value integrity, collaboration, excellence, intellectual honesty, and diversity of thought. We strive to be included in the top quartile of university endowments by generating superior investment returns, maintaining an exceptional reputation, and serving as a true partner to the University. Our leadership team members bring strong investment acumen, diverse skill sets, deep knowledge of the industry, and enthusiasm to serve the University every day. Meet the Leadership Team.